Top First Payroll Management Service in Ahmedabad

Ten Trends Shaping Payroll Management in 2025

In an especially competitive, candidate-centric employment market, a well-thought-out payroll management system may create a difference. These are the top ten trends any payroll manager or business owner should be aware of to really influence 2025.

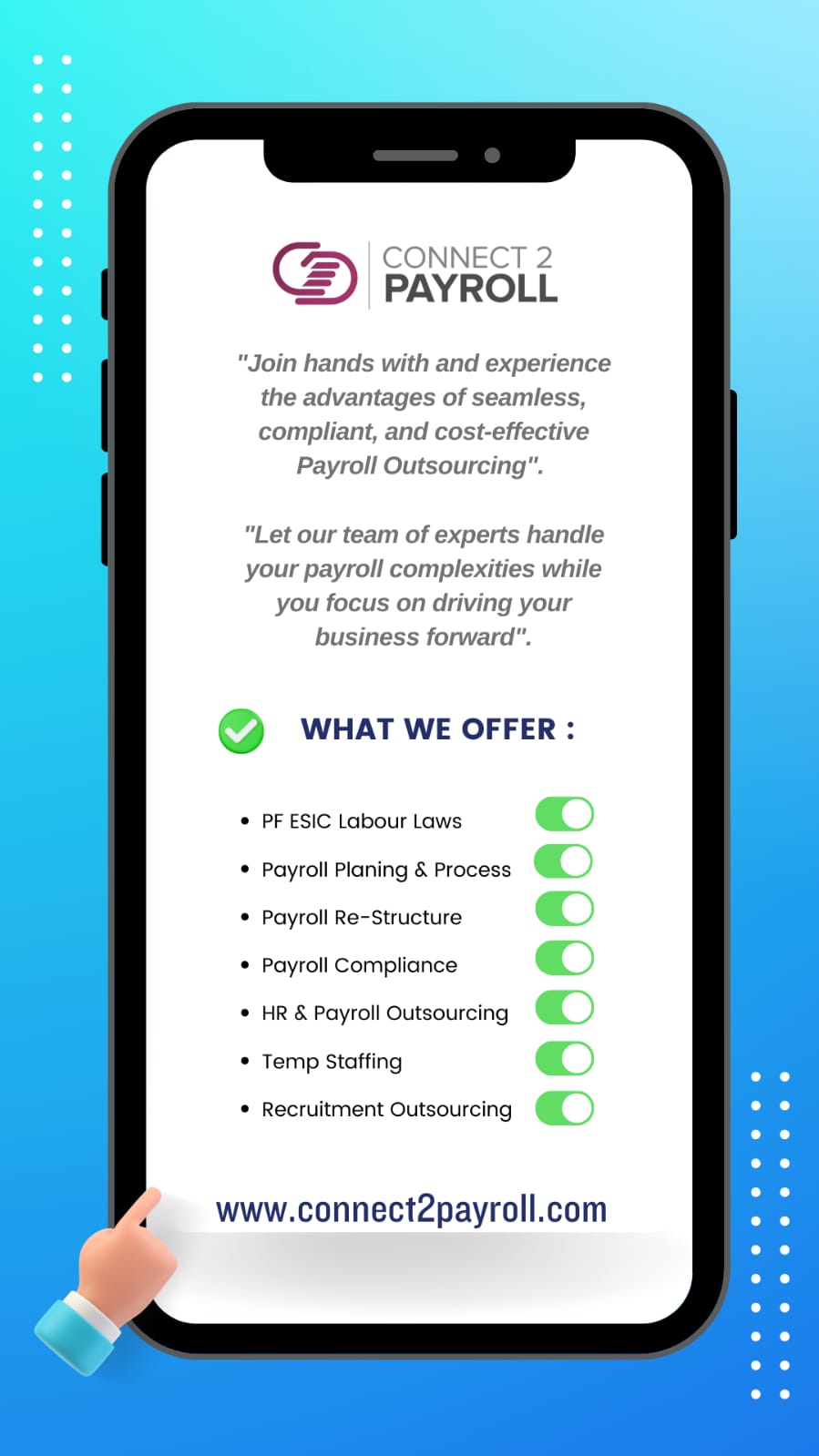

Employers should work harder to attract great people and ensure they remain with the business given falling unemployment rates and a growing skills gap. Regardless of sector or size, companies must first simplify payroll before benefits and involvement strategies. That is the reason we are seeing a deluge of new technology meant to transform payroll administration in 2025. Not only can it simplify the lives of HR managers by lowering manual work at month-end, but it will also promote digitalized payroll as a value add to keep high-performing people. Connect 2 Payroll Management Service Provider Company in Ahmedabad India.

These 10 payroll management trends may be anticipated to mature this year.

Automated Payroll will be completely GDPR-compliant— Payroll automation is founded on the idea that across sites and interfaces, employee data is effortlessly available. Any new payroll management system being brought to the market should be expected to be GDPR-compliant because the GDPR entered into effect in the middle of last year.

From day one, payroll will be Audit-ready; instead of rushing at quarter-end or year-end to gather and reconcile payroll data, companies may use automatic report production to allow electronic submission without any complex bureaucratic procedures.

As companies increasingly rely on gig workers, gig personnel will join your payroll; the difference between payrolled employees and third-party workers will start to erode. This covers blue-collar jobs as well as high-value projects conducted by knowledgeable people and the enlightened “digital nomad.”

Bots can assist with issue resolution; individuals moving from one department to another trying to get questions answered from HR Team, finance, or even accounting might be a familiar sight for us all. Standard response to the present issue in 2025 will be AI-based chatbots run as part of a larger manpower service suite or as stand-alone applications.

Manual Payroll will at last be out of date – A greater number of tiny enterprises can give up manual, paper-driven procedures with payroll automation eventually turning into extremely cost-effective likewise as simple-to-deploy. Growing knowledge of technology and a payroll solutions industry growth might accelerate this.

There will be more methods besides weekly or monthly payroll. Some solutions have already begun deploying flexible payroll systems that match salaries to a specific day every month or maybe assist one-time payments as part of a company’s normal disbursal cycle. Evidently, this may be totally in-line with gig worker needs.

Connect 2 Payroll Management Company Service Provider in Ahmedabad India are increasingly offering options to bi-weekly or monthly pay intervals. For a minimal or no-cost, Company is also looking at a flexible pay system that lets employees on-demand access to money without having to wait until payday.

Unbanked workers will be welcomed Contrary to common opinion, a great deal of the world population stays unbanked, especially in rich countries. Platforms like as payroll solution can help to integrate this personnel area within the payroll management range, hence simplifying access to the wages they really received.

Disbursal is instant; payroll management will investigate instant payment possibilities based on the great popularity of mobile payment apps, so employees don’t have to wait for a certain time period once their shift/project/seasonal stay with a business has ended.

Financial well being is included in the package; by stressing the need of financial wellness, companies may guarantee their workforce is available to manage a certain standard of life and effectively use their assigned salaries. Financial wellness perks in 2025 help to increase employee happiness without ongoing wage increases.

Everywhere, pay openness will be the standard. From ensuring that regular payment and compensation levels are kept private, progressive companies might consider publicly disclosing salary levels throughout white-collar ranks to part-time workers. This will lead to a more comprehensive strategy in strengthening employer brand, conveying the ideals of honest pay and equality.

These are the top ten payroll management trends we usually expect to see over the next several months. Driven by wide scale digitalization on one side and a drive toward outsourcing the whole payroll process to a third-party agency on the other, 2025 is expected as the year payroll management will see a favorable change.

Of those payroll management trends, which ones do you wish to implement in 2025? Tell us about your payroll management path in the comments below.