In the present fast-paced along with competitive organization setting, businesses are continually looking for ways to reduces costs of their monetary functions, develop hard cash stream, and reduce administrator overhead. One option becoming popular is factoring, financial program that allows firms to transform their receivables into speedy cash best invoice factoring software. To regulate along with improve your factoring approach effectively, businesses are checking out . This informative article considers factoring software program, the benefits, attributes, along with what can enhance organization operations.

What is Factoring?

Factoring is really a monetary layout exactly where a small business has for sale the reports receivable (invoices) in order to 1 / 3 social gathering, known as aspect, at a discount. In return for, the business enterprise draws speedy hard cash, so it can use to get business wants for instance forking over staff, acquiring inventory, as well as broadening operations. In the event the client will pay your expenses, your aspect will take your check, minus their fee.

Factoring allows firms having weak as well as inconsistent hard cash stream prevent waiting 30 in order to ninety days to get client payments. Instead, they’re able to access speedy doing the job cash, which assists manage easy functions along with growth.

What is Factoring Software?

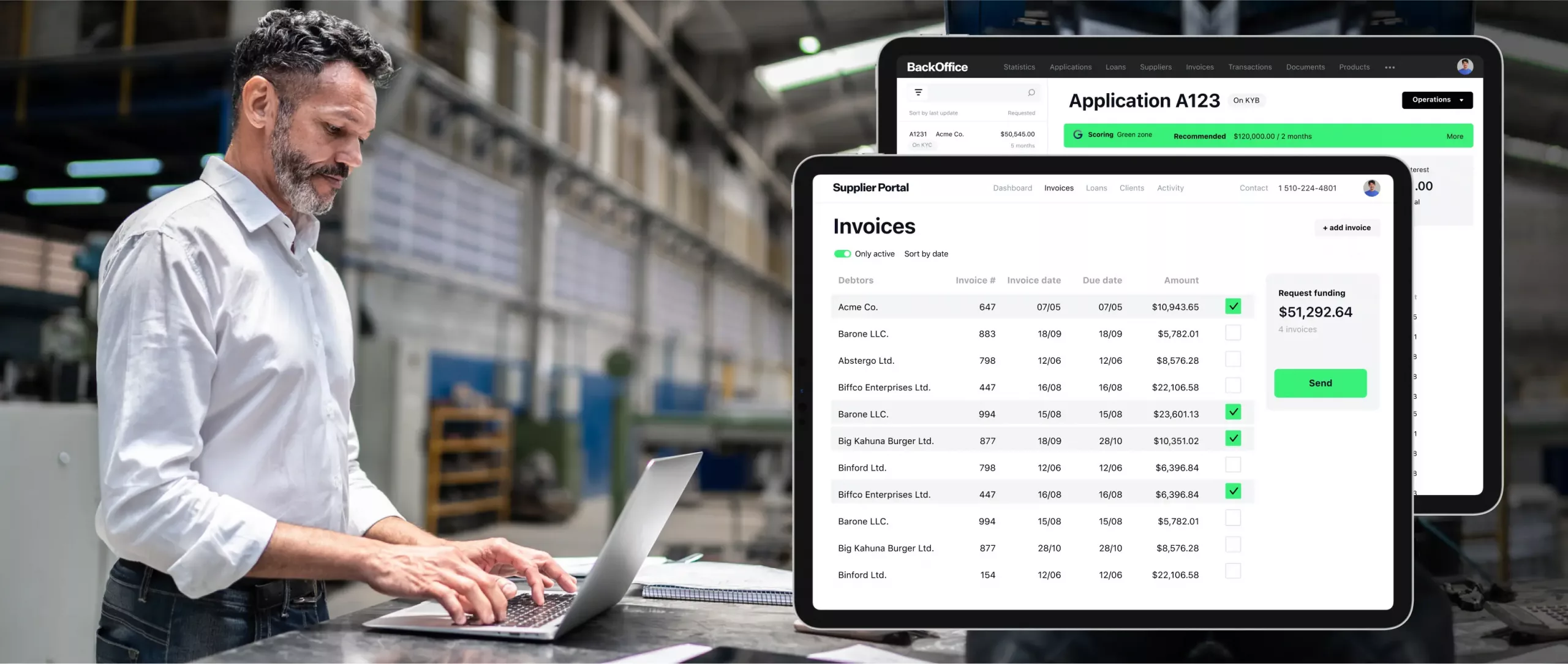

Factoring application is your specific resource built to improve along with enhance the entire factoring process. That streamlines chores for example expenses operations, check checking, possibility analysis, along with customer communication. Factoring software program ordinarily consists of an array of attributes which help factoring businesses along with firms control the acquisition along with assortment of receivables effectively.

Your definitive goal associated with factoring application is to get rid of guidebook procedures, reduce potential risk of man oversight, and give real-time rankings in to the rank associated with transactions. By means of automating factoring, firms can give attention to expansion as an alternative to finding bogged lower by means of time-consuming administrator tasks.

Features of Factoring Software

- Expenses Control: Factoring software program simplifies the entire process of publishing along with checking invoices. It includes an organized program exactly where firms can simply publish, retail store, along with access invoices. Software program as well makes it possible for consumers in order to your rank of each invoice—no matter whether it’s been paid for, is impending, or possibly is overdue—making sure much better rankings of funding flow.

- Real-Time Confirming along with Analytics: With factoring software program, consumers can crank out specific reports along with analytics to evaluate your functionality of the factoring operations. Software program songs critical achievement for instance fantastic balances, maturing reports, customer check developments, along with factoring fees, empowering firms to make informed decisions.

- Robotic Notifications along with Pointers: Factoring software program can give programmed ticklers in order to clientele about expected payments. The following reduces the guidebook energy required to follow up on fantastic statements along with promotes hard cash stream management. What’s more, it elevates client interactions through providing timely along with consistent communication.

- Threat Examination along with Credit ratings Scoring: Lots of factoring software program options include built-in credit ratings credit scoring attributes in which look at the creditworthiness associated with customers. The following aspect makes it possible for factoring businesses to investigate possibility before acquiring receivables, making sure they help clientele that have a high possibility of forking over their debts for time.

- Expenses Backing along with Disbursement: Factoring software program allows improve the entire process of funding invoices. The moment a good expenses qualifies, the computer can compute your funding amount along with disburse hard cash in order to the business enterprise quickly. A number of software program options even provide the choice of instantaneous as well as same-day funding, that is specially useful to get firms that want speedy liquidity.

- Report Control: Software program permits your hard drive along with operations of pertinent paperwork related to factoring transactions. This can include legal papers, statements, customer communications, along with check records. With file operations attributes, firms can access all of important papers from the core platform reducing records clutter.

- Client along with Client Website: Lots of factoring software program options produce a website for the factoring firm and their clients. The following website enables clientele to view your rank of the statements, create repayments, along with speak with your factoring company. The following self-service option cuts down the advantages of recurrent message or calls as well as e-mails, time savings both for parties.

- Security along with Submission: Factoring software program ensures info basic safety by means of shield of encryption, secure user access settings, along with typical backups. It can also help firms stick to rules related to info protection along with monetary credit reporting, including the Normal Facts Safeguards Legislation (GDPR) along with anti-money laundering (AML) requirements.

Benefits of Factoring Software

- Increased Cash Move: Factoring software program makes it possible for firms to obtain speedier having access to doing the job cash by means of simplifying along with automating your factoring process. With quicker producing periods along with effective checking associated with receivables, firms can boost their hard cash stream, which is crucial for having daily operations.

- Efforts and Price Savings: By means of automating chores for instance expenses checking, check ticklers, along with credit reporting, factoring software program cuts down the advantages of guidebook intervention. Blocked time frame and expense benefits, enabling staff to focus on more ideal chores as an alternative to administrator chores.

- Improved Threat Control: With built-in credit ratings possibility examination along with credit ratings credit scoring, factoring software program allows firms lessen potential risk of handling difficult to rely on customers. It will aid prevent high-priced defaults along with poor bad debts which could in any other case interrupt hard cash flow.

- Elevated Client Associations: Factoring software program can develop interaction among firms along with the clientele through providing consistent, computerized changes for expenses status. Clientele make use of timely ticklers along with practical check selections, that may grow their expertise along with bolster the business enterprise relationship.

- Structured Procedures: Your centralization associated with factoring functions into a person platform would make it simpler for firms to manage many clientele, statements, along with purchases with once. Software program streamlines the entire factoring approach, through funding in order to check checking, making sure smoother operations.

- Improved Decision-Making: Your real-time info along with analytics supplied by factoring software program provide firms having useful insights in their factoring performance. These kind of insights could be used to make better monetary choices, establish developments, along with enhance organization operations.

How Factoring Software Helps Different Types of Businesses

- Modest Companies: Small establishments having reduced hard cash stream can drastically make use of factoring software program as it allows them to access doing the job cash quickly. By means of entrusting your administrator stress in order to factoring software program, they’re able to give attention to expansion without having being concerned concerning past due invoices.

- Factoring Corporations: Factoring application is specifically used by factoring firms that control significant lists associated with invoices. Software program enables them examine customer creditworthiness, control many clientele, along with improve the entire factoring approach, producing functions more efficient along with scalable.

- Freight along with Strategies Corporations: Freight factoring is usual from the transfer business, exactly where trucking businesses normally count on factoring to increase hard cash flow. Factoring software program customized for the goods business can control trucker statements, facilitate timely repayments, and give specific credit reporting to get much better decision-making.

- Support Solutions: Service-based companies that issue statements for his or her companies, for example promotion agencies, installers, as well as IT companies, also can make use of factoring software. That allows them to swiftly aspect statements, creating more cash to fund continuing initiatives along with increase operations.

Conclusion

Factoring application is an essential resource to get firms seeking to reduces costs of their factoring procedures along with boost their hard cash flow. By means of automating chores for instance expenses operations, check checking, along with customer sales and marketing communications, factoring software program helps you to save time frame, cuts down man oversight, along with promotes general efficiency. The advantages are not just confined to small establishments but in addition increase in order to factoring businesses, repair shops, along with statigic planning businesses.

The chance to control receivables, examine credit ratings possibility, along with get real-time insights into monetary functionality would make factoring software program an important investment to get businesses wanting to grow their monetary operations. Regardless of whether your industry is wanting to develop the liquidity as well as reduces costs of functions, factoring software program provides resources essential to reach an aggressive marketplace.