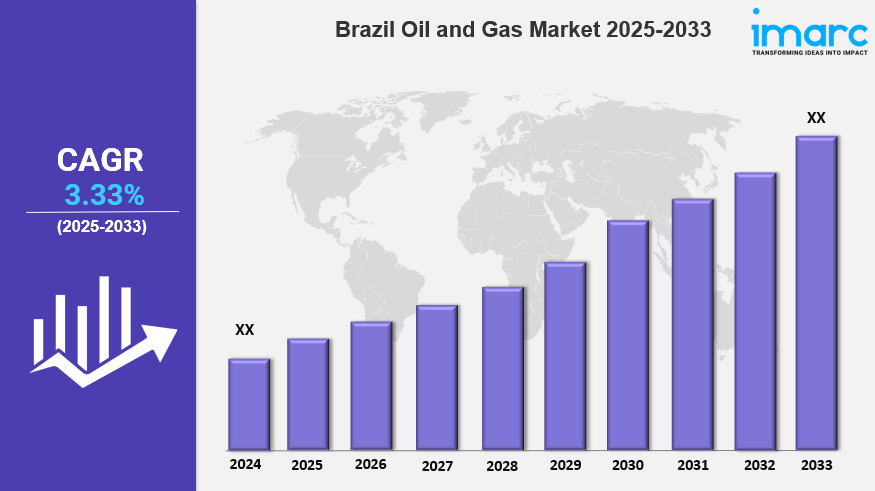

Market Overview 2025-2033

The Brazil oil and gas market size is projected to exhibit a growth rate (CAGR) of 3.33% during 2025-2033. The vast offshore oil and gas reserves in the country, favorable government policies and regulatory framework, increasing energy demand, and a commitment to cleaner energy sources represent some of the key factors driving the market.

Key Market Highlights:

✔️ Strong expansion driven by rising energy demand & offshore discoveries

✔️ Growing investments in deepwater and pre-salt oil exploration

✔️ Increasing focus on sustainable practices & carbon reduction initiatives

Request for a sample copy of this report: https://www.imarcgroup.com/brazil-oil-gas-market/requestsample

Brazil Oil and Gas Market Trends and Drivers:

Brazil oil and gas market is seeing strong growth in 2025, largely driven by offshore exploration and production. The country’s vast pre-salt reserves, located in deep and ultra-deep waters, continue to attract significant investment from both domestic and international oil companies. Brazil’s National Agency of Petroleum, Natural Gas, and Biofuels (ANP) has been actively auctioning offshore blocks, ensuring a steady flow of capital into the sector. Companies such as Petrobras, Shell, and Total Energies are expanding their operations in these fields, using advanced drilling technology to improve efficiency.

The government’s focus on offshore development is further supported by policies aimed at encouraging foreign investment and reducing regulatory barriers. With global energy demand on the rise, Brazil’s ability to sustain high production levels strengthens its position as a key player in the international oil market. However, environmental concerns, high operating costs, and fluctuating crude oil prices present challenges to long-term growth. Despite these risks, new offshore discoveries and production advancements are expected to keep Brazil at the forefront of global oil supply, contributing to both energy security and economic growth.

Natural gas is playing an increasingly important role in Brazil’s energy mix, as the country seeks to reduce its dependence on hydroelectric power and diversify its sources. The government has introduced reforms, such as the New Gas Law, to open up the market to competition and attract private-sector investment. As a result, companies are investing in new LNG terminals, pipelines, and gas processing facilities to improve supply and distribution.

Energy firms are also looking to develop offshore gas fields to boost local production. At the same time, Brazil is likely to increase LNG imports to meet growing demand. The expansion of gas-fired power plants and incentives for industries to switch from more polluting fuels are further driving market growth. However, infrastructure challenges and pricing fluctuations remain key hurdles that need to be addressed to unlock the full potential of Brazil’s gas sector.

As the world moves towards cleaner energy, Brazil’s oil and gas industry is focusing on reducing carbon emissions and improving environmental responsibility. Oil companies operating in the country are adopting carbon capture and storage technologies to cut emissions from extraction and refining. Investment in biofuels and hydrogen is also gathering pace, as Brazil looks to balance its oil production with more sustainable energy options.

The government is enforcing stricter environmental regulations to ensure energy companies meet sustainability standards. Petrobras and other major firms are prioritising low-carbon initiatives, such as methane reduction and renewable energy integration. Meanwhile, plans for offshore wind projects and the development of sustainable aviation fuel highlight Brazil’s commitment to a greener energy future. While oil and gas remain central to the economy, the industry is gradually aligning with global energy transition trends to stay competitive in a changing market.

Brazil Oil and Gas Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Brazil oil and gas market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Sector:

- Upstream

- Midstream

- Downstream

Breakup by Region:

- Southeast

- South

- Northeast

- North

- Central-West

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145