Venmo has quickly become a household name worldwide as an innovative mobile payment system that make payment and allows people to send funds back and forth between friends. However, you should know about the limits placed on the Venmo transactions. The main limit to transfers is for the weekly limits, which sets a limit on much can be send or received each week. These limits depend on factors such as identity verification status and the transaction type.

For instance, when you sign up for Venmo account the initial limit is $299.99 per week that can be used for transactions. Once this limit has been exceeded, there are various means available to increase it, verifying identity on Venmo. After verification you have higher Venmo weekly limit is up to $499.99. So, let’s begin learn more about how much you can send spend, and withdraw on Venmo.

Brief Overview of Venmo as a Peer-to-Peer Payment Platform

Venmo can be defined as an online peer-peer (P2P) payment platform provided by PayPal that allows its users to transfer money directly between family and friends using their mobile apps. This makes it an effective solution for transferring funds between accounts instantly. Moreover, you can easily connect the Venmo to bank account, debit card or credit card to transfer funds immediately.

Through Venmo’s social feature you can add comment and emoji’s this makes the app appealing to younger generations who prefer engaging casually and freely. Moreover, individuals typically set lower limits than businesses when opening verified accounts for electronic transfer, to protect against fraud and stay within banking regulations governing electronic transfers. You can increase Venmo limit by verifying your identity or opening accounts at specific financial institutions – methods which also can assist with other verification processes like hiring or renting the process.

What Is the Venmo Weekly Limit?

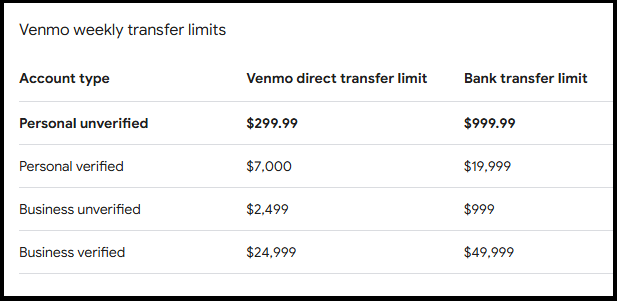

Venmo weekly transaction limits represent how much can be spent, transferred, or withdrawn within 7 calendar days. Venmo limits are put in place to protect both customers and Venmo itself by ensuring transactions remain safe, and complying with laws regarding financial transactions. The Venmo limits can differ on what kind of transaction you are conducting- for instance paying bills, purchasing goods, transferring funds into account you prefer, and making purchase with your debit card etc. Moreover, there are different limits for verified and unverified Venmo accounts.

What is the difference Between Verified and Unverified Venmo Accounts?

One of the key factors of your Venmo limit is whether you account has been verified. Verified users submit additional information about themselves to verify their authenticity, while accounts that have not gone through verification do not. Here is are the main differences between verified and unverified Venmo account:

- Verified Accounts: When verifying an account that has been set up with Venmo, Venmo will collect details that include your full name, birth date, address, birthday and last four numbers of your Social Security Number (SSN). This helps Venmo confirm your identity while increasing security on bank accounts where you hold accounts – thus giving verified users higher transaction limits than unverified users.

- Unverified Accounts: Venmo considers accounts that have not been verified as unverified accounts because they lack additional details required from them by Venmo for use and verification. Although these accounts can still use Venmo services to pay or send transactions, but there may be certain restrictions because Venmo has not confirmed them as authenticated entities.

What are the Venmo Weekly Limits for Different Activities?

The Venmo weekly limits may vary based on different activities. Here is what you need to know:

- Sending Payment to Other Users: Venmo sets a weekly limit of $299.99 on transactions to unverified users. Once verified this Venmo sending limit will increase. Verified Venmo accounts offer a maximum weekly for sending money of $4,999.99; this makes transferring more funds easier when needed to cover bills, rent payment, or group costs.

- Authorized Merchant Payments: Venmo makes it simple and safe to pay merchants with your balance or linked payment options, including payments to individuals. The transaction limits differ for merchant specific payments versus those for those for individual payments. For instance, Venmo accounts that are not verified have a weekly limit for authorized merchant payments of $299.99. or less. Moreover, verified accounts allow merchants that have been approved to conduct authorized transactions to make weekly transactions up to $4,999.99 per week.

- Bank Transfers (Instant and Standard): Venmo transfers from banks offer two options for funds transfer – standard transfers and instant transfers. Both allow users to move money from their Venmo balance into bank accounts quickly; the difference lies in when funds become accessible.

- Standard Transfers: When sending money in a standard transfer format, funds usually arrive between three and five business days at your account. Your Venmo maximum weekly limit with verified accounts for standard transfers is $5,000.

- Instant Transfers: The instant transfer on Venmo provide an efficient means for quickly moving funds between Venmo and bank accounts quickly, but come at the cost of one. Your Venmo weekly limits of instant transfers range up to $2,999.99.

- Venmo Debit Card Transaction: Venmo provides debit cards that enable consumers to buy products anywhere Mastercard is accepted, with daily limits determined by transaction type and frequency. For instance, your spending maximum for debit card purchases made within 7 days can reach $4,999.99. If your Venmo account has not been verified yet, its spending limit would be $299.99 for debit card transactions.

How to Increase Your Weekly Limit?

If the weekly limit on Venmo is not meeting your need, you can increase this by verifying your account. To do this, you need to provide personal details like your full name, date of birth, and last four digits of social security number. If this method does not do it for you however, or if additional limits may exist outside standard verification processes you could reach out to Venmo support and inquire further as there may be additional ways of increasing limits available if necessary.

How Much You Can Withdraw Weekly via Venmo?

When withdrawing funds from Venmo, your weekly withdrawal limit depends on how you take out the money. For account transfers to bank accounts linked, regular transfers may only go as high as $5,000 while instant transfers have an upper limit of $2,999.99 every week. Moreover, the ATM withdrawals using Venmo debit cards usually reach about 400 per day of the week.

FAQ

Does the weekly limit reset on a specific day?

Yes, but your Venmo transaction limits will reset every seven weeks, starting from the time you complete a one-off transaction.

Can you request a higher limit from Venmo?

Yes, you can request a higher limit from Venmo, by verifying your account and linking a bank account.

What happens if you try to exceed your limit?

If you attempt to exceed limits for the week, Venmo will block the transaction from being processed and issue an error message informing customers that it may not be completed due to their limit.

Why can’t I send more than $1000 on Venmo?

If you are having difficulty sending more than $1000, the reason could be due to your account not being verified. You must verify identity on Venmo to get higher sending limits.