Water damage is one of the most common and costly problems homeowners face. Whether caused by a burst pipe, a heavy rainstorm, a leaking roof, or a malfunctioning appliance, water can cause significant damage to your home and belongings. The cost of repairing water damage can be overwhelming, but water damage insurance is here to help protect you.

At Joe Hensley Public Insurance Adjusters, we understand how stressful it can be to deal with the aftermath of water damage. Our role is to help homeowners and business owners navigate the insurance claims process, ensuring that they receive the full compensation they deserve. In this blog post, we’ll explore everything you need to know about water damage insurance—how it works, what it covers, and how we can assist in filing your claim.

What Is Water Damage Insurance?

Water damage insurance is a type of insurance that helps cover the costs of repairing and replacing property damaged by water. However, it’s important to note that not all water damage is covered by a standard homeowners insurance policy. Joe Hensley Public Insurance Adjusters helps you understand what your policy covers and works to ensure you get the compensation you deserve.

Types of Water Damage Insurance Coverage

Water damage insurance can be broken down into two main types:

-

Homeowners Insurance

Many homeowners insurance policies include coverage for water damage caused by sudden and accidental events, such as a burst pipe or an appliance failure. This may cover the repair of water-damaged floors, walls, ceilings, and furnishings. However, it does not typically cover water damage caused by flooding or sewer backups. -

Flood Insurance

Flood insurance is a separate policy that provides coverage for water damage caused by floods. This can include damage from rising rivers, overflowing lakes, heavy rain, or other natural disasters that lead to flooding. If you live in a flood-prone area, it’s essential to have flood insurance, as standard homeowners insurance won’t cover flood-related damage.

What Does Water Damage Insurance Cover?

While the specifics of coverage vary from one policy to another, water damage insurance typically covers the following:

1. Repairing Water-Damaged Property

If water damages your home, your insurance policy may cover the cost of repairs to structural components such as walls, flooring, and ceilings. It may also cover damage to built-in appliances and fixtures, such as kitchen cabinets, plumbing, and electrical systems.

2. Replacement of Damaged Belongings

Many policies will reimburse you for personal property lost due to water damage, such as furniture, electronics, clothing, and jewelry. Depending on the policy, this coverage may be based on the actual cash value or the replacement cost of your belongings.

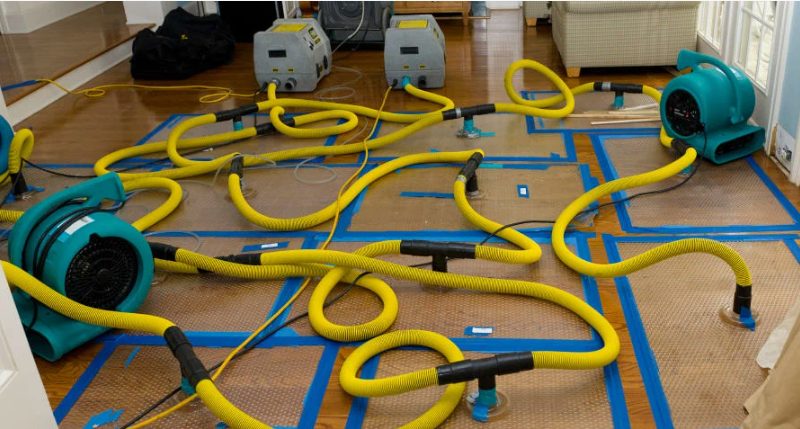

3. Water Extraction and Cleanup

Water removal and cleanup are essential to prevent further damage, such as mold growth. Insurance may cover the cost of hiring professionals to extract water, dehumidify the space, and clean and disinfect affected areas.

4. Mold Remediation

If Water Damage leads to mold growth, your insurance may cover the cost of mold remediation, provided the water damage was caused by a covered event (e.g., a burst pipe). However, mold damage caused by long-term moisture exposure or neglect is typically not covered.

What Water Damage Insurance Does Not Cover

While water damage insurance can provide valuable protection, there are several exclusions you should be aware of. Here’s what is typically not covered under a standard homeowners policy:

1. Flood Damage

Flooding caused by heavy rain, hurricanes, or rising rivers is not covered by homeowners insurance. To protect yourself from flooding, you’ll need to purchase separate flood insurance.

2. Sewer Backup

Water damage resulting from a sewer backup is often excluded from standard homeowners insurance. However, you can add a sewer backup endorsement to your policy for additional coverage.

3. Negligence

Water damage caused by long-term neglect, such as failing to maintain your plumbing or roof, is usually not covered. Insurance providers expect homeowners to take reasonable care of their property.

4. Wear and Tear

Insurance is not designed to cover damage from normal wear and tear. For example, if your water heater fails due to age, it may not be covered by insurance.

The Water Damage Insurance Claims Process

When you experience water damage, it’s crucial to follow the right steps to ensure your claim is handled quickly and efficiently. The process can be overwhelming, especially when dealing with significant damage to your home. Here’s a simple guide to help you navigate the claims process:

Step 1: Assess the Damage and Document It

The first step is to assess the extent of the damage. Take photos and videos of all the affected areas—inside and outside your home. This documentation will be essential when filing your claim. Make sure to include close-up shots of damaged items, as well as wide-angle views of the entire area.

Step 2: Contact Your Insurance Provider

Notify your insurance provider as soon as possible. Most policies require you to report the damage within a certain timeframe—often 24 to 48 hours after the incident. Be prepared to provide your insurance policy number and a detailed description of the damage.

Step 3: Hire a Public Insurance Adjuster

Joe Hensley Public Insurance Adjusters can help you manage the claims process from start to finish. A public adjuster works on your behalf (not the insurance company’s) to ensure that your claim is handled fairly and thoroughly. We’ll inspect the damage, review your policy, and help you document the loss to maximize your settlement.

Step 4: Get Professional Estimates

After the insurance company sends out an adjuster, it’s a good idea to get estimates from contractors or restoration specialists. These estimates will give you a better idea of how much the repairs will cost and can be used to negotiate a fair settlement.

Step 5: Negotiate and Settle

Once your claim is filed and the insurance adjuster has reviewed your documentation, you may receive an offer for settlement. If the offer seems too low, Joe Hensley Public Insurance Adjusters will negotiate on your behalf to ensure you receive the compensation you need to cover all necessary repairs and replacements.

Why Choose Joe Hensley Public Insurance Adjusters?

At Joe Hensley Public Insurance Adjusters, we are dedicated to helping property owners recover from water damage by maximizing their insurance claims. Our experienced team will guide you through every step of the claims process, ensuring that your damage is properly documented and that you receive a fair payout. Here’s why you should choose us:

-

Expert Claim Assistance: We understand the nuances of water damage insurance and can help you navigate the complexities of your policy.

-

Thorough Inspections: Our team conducts thorough damage assessments to ensure no detail is overlooked.

-

Aggressive Negotiation: We negotiate on your behalf to ensure you receive the maximum compensation for your losses.

-

Personalized Service: We work with you directly, providing one-on-one support throughout the entire claims process.

Final Thoughts on Water Damage Insurance

Water damage can be devastating, but with the right insurance coverage, you can protect yourself and your property. Understanding your policy, knowing what is and isn’t covered, and working with a professional public insurance adjuster can make all the difference in securing a fair settlement.

If you’ve experienced water damage or want to learn more about your coverage options, Joe Hensley Public Insurance Adjusters is here to help. We’ll ensure that your claim is properly handled, so you can get your home back to normal as quickly as possible.

FAQs

1. Does water damage insurance cover flood damage?

No. Water damage insurance generally does not cover flooding caused by heavy rain, hurricanes, or rising rivers. You’ll need separate flood insurance for this.

2. How do I know if my water damage claim will be approved?

If the damage is sudden and accidental, such as a burst pipe, it’s likely to be covered. However, damage from neglect or wear and tear is typically excluded. Contact a public adjuster to help assess your claim.

3. Should I hire a public adjuster for my water damage claim?

Yes. A public adjuster works on your behalf and ensures that your claim is properly documented and fully compensated. We help you navigate the insurance process to get the best possible outcome.