Market Overview 2025-2033

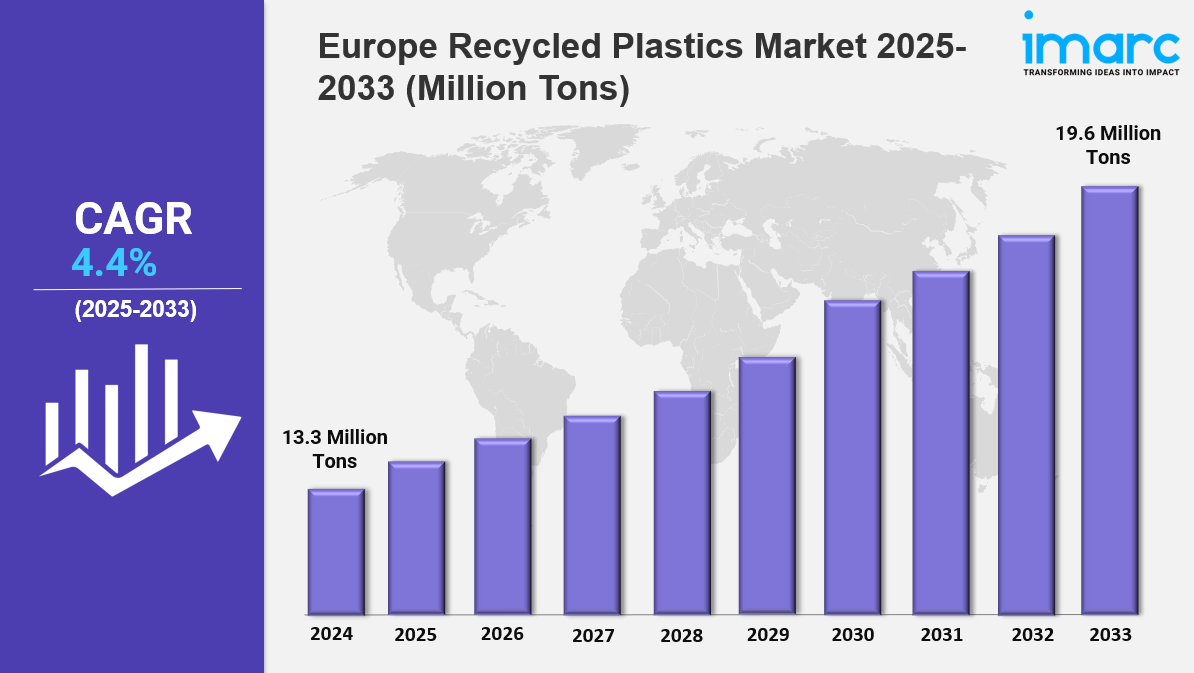

The Europe recycled plastics market size reached 13.3 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 19.6 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The market is growing due to increasing environmental awareness, strict government regulations, and rising demand for sustainable materials. Technological advancements, corporate sustainability initiatives, and recycling innovations are key factors driving industry expansion.

Key Market Highlights:

✔️ Strong market growth driven by increasing environmental awareness and sustainability initiatives

✔️ Rising demand for recycled plastics in packaging, automotive, and construction industries

✔️ Expanding government regulations promoting circular economy and waste management solutions

Request for a sample copy of the report: https://www.imarcgroup.com/europe-recycled-plastics-market/requestsample

Europe Recycled Plastics Market Trends and Drivers:

The European recycled plastics market is experiencing accelerated growth due to stringent regulatory frameworks aimed at reducing virgin plastic consumption. The EU’s revised Circular Economy Action Plan and Single-Use Plastics Directive have mandated that member states achieve a 30% recycled content in plastic packaging by 2030, with interim targets already reshaping industry practices. In 2024, this regulatory push has forced manufacturers to rapidly adopt recycled polymers, particularly in packaging, automotive, and construction sectors. For instance, France and Germany have introduced tax incentives for companies exceeding 25% recycled content, while non-compliant businesses face steep penalties.

This dynamic has spurred cross-border collaborations, such as the Nordic Recycling Alliance, which pools post-consumer plastic waste from Sweden, Norway, and Denmark to meet regional demand. However, uneven recycling infrastructure across Eastern Europe continues to create supply chain bottlenecks, with countries like Poland relying heavily on imports of recycled PET flakes from Western processing hubs. Brands across Europe are pivoting toward recycled plastics to align with eco-conscious consumer preferences, with 68% of EU shoppers in 2024 willing to pay a premium for products using post-consumer resins. Retail giants like H&M and Unilever have publicly committed to 100% recycled plastic packaging by 2025, creating unprecedented demand for high-quality recycled polymers. The food-contact-grade recycled PET segment has seen particularly sharp growth, driven by Coca-Cola EU’s €300 million investment in Belgian and Spanish recycling plants.

However, this surge has exposed critical gaps in material traceability, prompting blockchain startups like Circulor to partner with BASF and Suez on real-time recycling audits. Paradoxically, the demand-supply imbalance has caused recycled HDPE prices to soar by 22% year-on-year in Q2 2024, pushing smaller manufacturers toward alternative bioplastics. Advanced sorting technologies and chemical recycling innovations are reshaping Europe’s recycled plastics landscape. In 2024, German firm Saperatec deployed AI-powered hyperspectral imaging systems that achieve 99% purity in multilayer plastic separation—a 40% efficiency gain over traditional methods. Simultaneously, Carbios’ enzymatic depolymerization plants in France now convert 50,000 tons of PET waste annually into virgin-quality resin, attracting partnerships with L’Oréal and Nestlé.

These advancements have enabled the EU to recycle 42% of its plastic waste in 2024, up from 32% in 2020. Yet, scalability challenges persist: only 12% of Europe’s 300 chemical recycling projects have reached industrial capacity, constrained by energy costs averaging €120/MWh for plasma gasification processes. Europe’s recycled plastics sector is being propelled by a unique convergence of regulatory rigor and technological ambition. While the Circular Economy Package sets the legislative foundation, 2024 has emerged as a pivotal year for operationalizing these goals through large-scale infrastructure projects. The €2.1 billion Plastic Waste-to-Resins Fund, launched jointly by the European Investment Bank and private equity firms, is financing 14 megaprojects, from Portugal’s integrated PET biorecycling hub to Finland’s circular polyolefin network.

Concurrently, evolving Extended Producer Responsibility (EPR) schemes now penalize “greenwashing” by requiring third-party certification of recycled content claims—a move that has standardized procurement processes for automakers like Volkswagen and Renault. Despite these strides, the market remains bifurcated: Western Europe accounts for 78% of recycled polymer production, while Eastern states lag due to reliance on low-cost virgin plastic imports from Russia and Saudi Arabia. As carbon border taxes on virgin plastics take effect in 2026, analysts project the EU recycled plastics market will grow at a 9.8% CAGR through 2030, potentially creating 500,000 jobs in advanced sorting and polymer engineering sectors.

Europe Recycled Plastics Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Source:

- Plastic Bottles

- Plastic Films

- Rigid Plastics and Foams

- Fibres

- Others

Breakup by Application:

- Packaging

- Electrical and Electronic

- Automotive

- Agriculture

- Construction and Demolition

- Household (Non-Packaging Use)

- Others

Breakup by Plastic Type:

- Polyethylene Terephthalate (PET)

- High Density Polyethylene (HDPE)

- Polypropylene (PP)

- Low Density Polyethylene (LDPE)

- Others

Breakup by Country:

- Germany

- UK

- Italy

- France

- Spain

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145