For freelancers, small business owners, and independent contractors, maintaining accurate earnings documentation is essential. Proper records help with tax filing, financial planning, and proof of income. A paycheck creator simplifies this process by generating precise pay stubs that reflect wages, deductions, and other earnings details.

This blog explores how a paycheck creator supports accurate earnings documentation and why it’s a must-have tool for individuals and businesses alike.

The Importance of Accurate Earnings Documentation

Keeping well-organized earnings records is crucial for:

- Tax Compliance – Ensuring proper tax reporting and avoiding penalties.

- Loan and Mortgage Applications – Providing proof of income when needed.

- Financial Planning – Tracking income trends for better budgeting.

- Business Transparency – Keeping clear records of employee and contractor payments.

How a Paycheck Creator Enhances Accuracy

1. Automated Calculations

A paycheck creator ensures all calculations, including wages, deductions, and taxes, are accurate, minimizing errors.

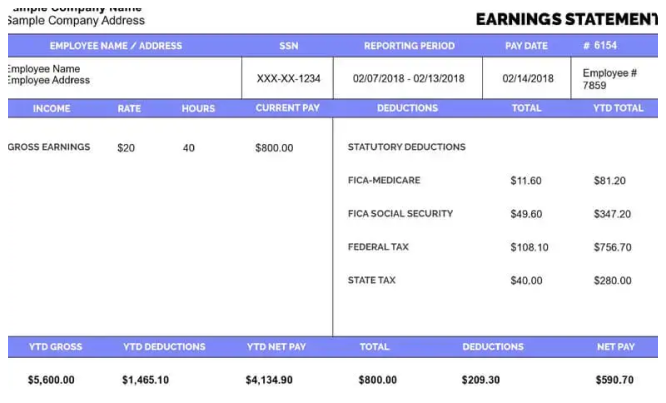

2. Clear Breakdown of Earnings

It provides a structured pay stub with details such as gross pay, net pay, tax deductions, and other withholdings, making documentation clear and professional.

3. Consistent and Reliable Records

Every paycheck generated is stored digitally or printed for record-keeping, ensuring freelancers and businesses maintain a structured history of payments.

4. Easy Access to Proof of Income

Freelancers and independent contractors often struggle to provide income verification. A paycheck creator provides legitimate pay stubs that act as proof of earnings.

5. Customization for Different Payment Types

Freelancers receive payments in various ways—hourly, per project, or retainer. A paycheck creator allows for customization based on these payment structures, ensuring accurate records.

Features of an Effective Paycheck Creator

- User-Friendly Interface – Easy to navigate for quick pay stub creation.

- Automatic Tax Calculations – Ensures accurate deductions and compliance with tax laws.

- Download and Print Options – Provides instant access to pay stubs for documentation.

- Cloud Storage – Keeps records safe and accessible.

Why Freelancers and Small Businesses Need a Paycheck Creator

- Simplifies Payroll Management – Reduces the complexity of tracking payments.

- Ensures Professionalism – Makes freelancers and small businesses appear more credible.

- Saves Time – Eliminates manual calculations and paperwork.

- Enhances Financial Organization – Keeps earnings structured and well-documented.

Conclusion

A Free paycheck creator is an essential tool for anyone who needs accurate earnings documentation. Whether you’re a freelancer, small business owner, or independent contractor, using a paycheck creator ensures financial transparency, simplifies payroll management, and provides clear income records. By leveraging this tool, you can maintain precise documentation and focus on growing your career or business with confidence.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?