Market Overview 2025-2033

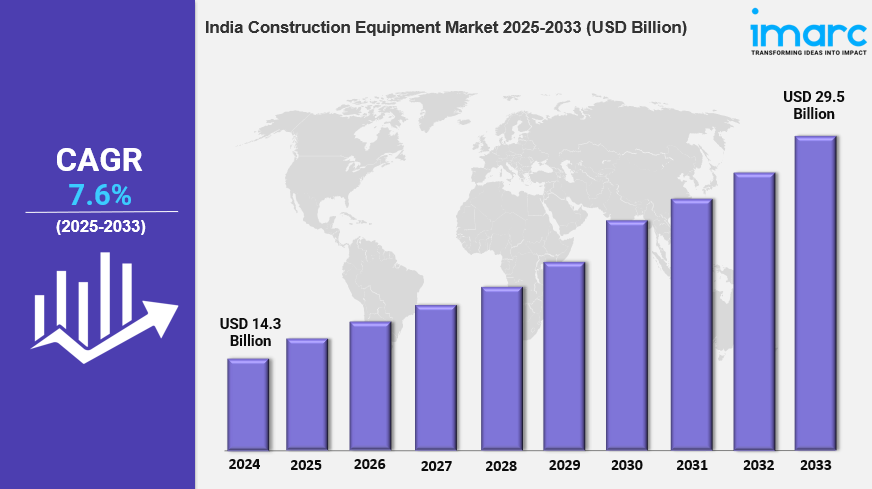

The India construction equipment market size reached USD 14.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.6% during 2025-2033. The rising investments in smart city projects by government bodies are primarily augmenting the market growth across the country.

Key Market Highlights:

✔️ Strong growth driven by infrastructure development & urbanization

✔️ Rising demand for advanced and specialized construction machinery

✔️ Increasing adoption of rental services and fleet management solutions

Request for a sample copy of the report: https://www.imarcgroup.com/india-construction-equipment-market/requestsample

India Construction Equipment Market Trends and Driver:

India’s construction equipment market is witnessing rapid growth, fueled by large-scale infrastructure projects and increasing urbanization. The government’s continued investment in building roads, highways, railways, airports, and housing developments has driven a surge in demand for heavy machinery like excavators, cranes, and loaders. As cities expand and smart city initiatives take shape, the need for high-performance equipment that can operate efficiently in challenging environments is rising. By 2025, the construction of ambitious infrastructure projects is expected to further boost demand for durable and technologically advanced machinery.

With urbanization on the rise, there is also a growing need for residential and commercial buildings, further propelling the demand for construction equipment. Government initiatives such as “Housing for All” and various rural and urban development programs are playing a crucial role in expanding the market across different regions.

To enhance productivity and efficiency, the construction equipment industry in India is rapidly adopting automation and advanced technology. Innovations like telematics, AI-driven fleet management, and autonomous machinery are revolutionizing operations by providing real-time data on machine performance, fuel usage, and maintenance needs. These advancements help reduce downtime and operational costs, making large-scale projects more efficient. In 2025, the use of digital tools for tracking equipment and predictive maintenance is expected to grow, allowing construction firms to streamline workflows and cut unexpected expenses.

Telematics systems enable fleet owners to maximize equipment usage, extend machinery lifespan, and ensure timely servicing. Meanwhile, autonomous vehicles and robotic equipment are transforming job sites by taking over repetitive tasks, improving safety, and boosting overall productivity. As the industry continues embracing technology, construction projects will become safer, more cost-effective, and highly efficient.

As construction activity grows and project demands fluctuate, equipment rental services are emerging as a cost-effective alternative for construction firms. Many companies prefer renting over purchasing expensive machinery, especially when projects require short-term deployments or flexible fleet scaling. By 2025, the rental market is expected to expand further as businesses look for budget-friendly solutions that eliminate ownership costs and maintenance concerns.

Additionally, fleet management solutions are becoming essential for optimizing rented equipment use. These systems help monitor machine performance, track fuel consumption, and manage maintenance schedules, ensuring efficient and safe operations. The combination of equipment rentals and fleet management is creating a more flexible and financially viable approach for construction firms, contributing to the steady growth of this segment in India’s construction equipment market.

India Construction Equipment Market:

The india construction equipment market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Solution Type Insights:

- Products

- Services

Equipment Type Insights:

- Heavy Construction Equipment

- Compact Construction Equipment

Type Insights:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

Application Insights:

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

Industry Insights:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145