Market Overview 2025-2033

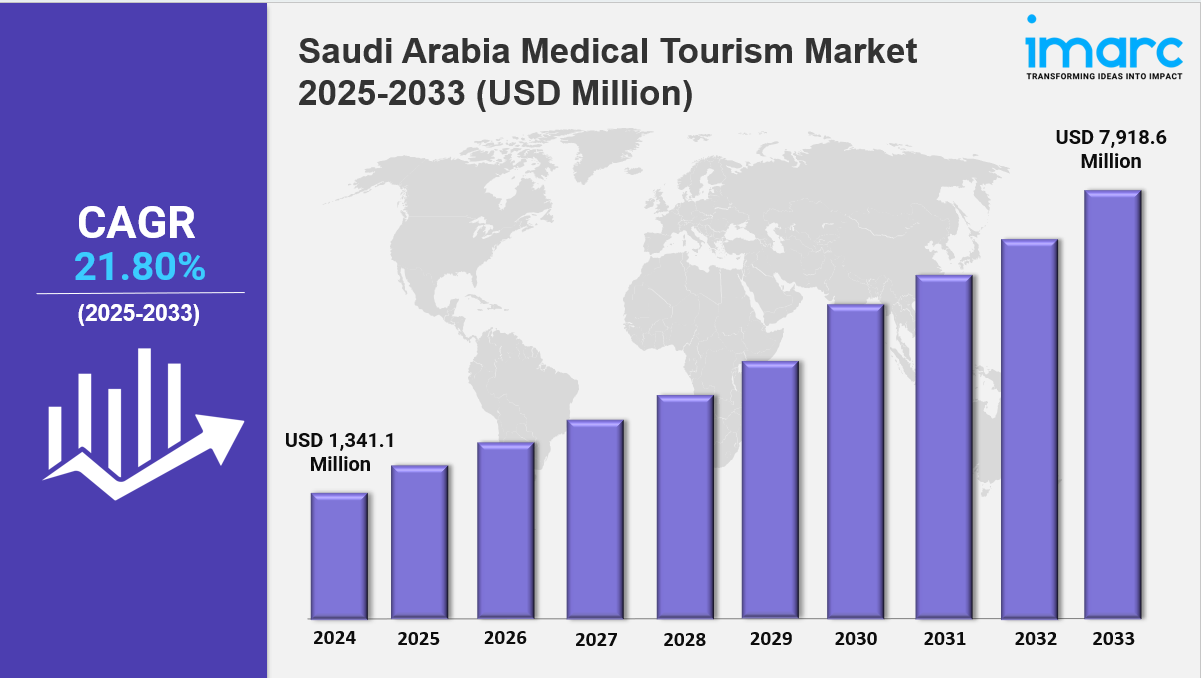

Saudi Arabia medical tourism market size reached USD 1,341.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,918.6 Million by 2033, exhibiting a growth rate (CAGR) of 21.80% during 2025-2033. The market is expanding due to rising demand for cost-effective treatments, advanced healthcare infrastructure, and strategic government initiatives. Growth is driven by Vision 2030, international accreditations, and integrated wellness offerings. With evolving patient preferences, the industry is becoming more dynamic, accessible, and globally competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising investments in healthcare infrastructure and specialized treatments

✔️ Increasing influx of international patients seeking cost-effective, high-quality medical services

✔️ Expanding government initiatives promoting Saudi Arabia as a regional hub for medical tourism

Request for a sample copy of the report: https://www.imarcgroup.com/saudi-arabia-medical-tourism-market/requestsample

Saudi Arabia Medical Tourism Market Trends and Drivers:

Saudi Arabia medical tourism market is booming due to new, high-quality healthcare facilities. The government’s Vision 2030 plan aims to diversify healthcare, with over $10 billion set aside for advanced medical cities. Notable projects include the King Faisal Specialist Hospital & Research Centre in Riyadh and the Johns Hopkins Aramco Healthcare facility in Dhahran. These hospitals specialize in high-demand areas like oncology, cardiology, and orthopedics. They attract patients from nearby Gulf Cooperation Council (GCC) countries, Africa, and Asia.

In 2024, the NEOM Health Sector opened. This futuristic hub features AI-driven diagnostics and robotic surgery. It positions Saudi Arabia as a leader in precision medicine. The country is also focusing on Joint Commission International (JCI) accreditations for over 40 hospitals. This effort builds trust with international patients, leading to a 22% increase in medical visa applications each year. This growth in infrastructure meets the rising global demand for affordable, high-quality care. Many uninsured people in Europe and North America seek cheaper treatment options. The Saudi medical tourism sector is using digital tools to improve access and patient experiences. In 2024, the Saudi Health Ministry launched the “Virtual Medical Tourism Platform.” This platform allows international patients to consult specialists online. They can compare treatment packages and get e-visas in 72 hours.

It has cut pre-arrival planning time by 35%, which helps busy patients. Meanwhile, hospitals like King Abdullah Medical City are using blockchain for health records and AI for triage. This reduces delays in care. Demand for tele-rehabilitation services, such as VR physiotherapy after surgery, has surged. This is especially true for Middle Eastern patients seeking ongoing care. These innovations support Saudi Arabia’s “Smart Health” strategy. The goal is to digitize 90% of healthcare services by 2030. Additionally, predictive analytics for personalized treatment plans and real-time translation tools make the market more attractive. Digital health investments exceeded $2.3 billion in 2024.

Saudi Arabia medical tourism market share is growing due to new policies and partnerships. In early 2024, the government launched the GCC Medical Tourism Visa. This visa lets patients from Bahrain, Kuwait, Oman, Qatar, and the UAE have multi-entry access for 18 months. That’s a 300% increase from the old validity period. At the same time, the Saudi Commission for Health Specialties (SCFHS) made it easier for foreign medical professionals to get licensed. This change helps hospitals hire top talent from Europe and North America.

Saudi Arabia has also formed strategic partnerships with global insurers like Allianz and Bupa. These partnerships have increased coverage for elective procedures, cutting out-of-pocket costs for international patients by up to 40%. The Ministry of Investment’s $500 million joint venture with Cleveland Clinic Abu Dhabi aims to create a hybrid care center in Jeddah. This shows Saudi Arabia’s goal of becoming a regional referral hub. These efforts have sparked a 17% annual rise in medical tourism revenue, reaching $1.2 billion in 2024. Cosmetic surgery, fertility treatments, and chronic disease management are the top revenue sources.

The Saudi Arabian medical tourism market is changing. It is moving from being a regional player to a global contender. This shift is driven by innovation and a focus on what patients want. A key part of this change is aligning healthcare services with the needs of wealthy medical tourists, especially those from the GCC and North Africa. In 2024, Saudi hospitals introduced bundled care packages. These packages combine advanced treatments, like robotic-assisted knee replacements, with luxury stays at Red Sea resorts. This led to a 28% increase in long-stay patients. Sustainability is also becoming important.

For instance, Riyadh’s Sultan Bin Abdulaziz Humanitarian City has achieved carbon-neutral status. It uses solar-powered medical facilities and zero-waste surgical protocols. However, the market faces challenges. Competition is rising in the MENA region, especially from the UAE’s established medical tourism corridors and Egypt’s affordable dental and cosmetic surgeries. To respond, Saudi Arabia is focusing on niche areas, such as gene therapy for rare diseases and health retreats for specific genders. They are also leveraging religious tourism by offering health screenings to 2 million Umrah pilgrims each year. With the Vision 2030 goals in sight, the market is expected to exceed $3.8 billion in annual revenue by 2027. This growth will change how the world views Saudi healthcare quality and access.

Saudi Arabia Medical Tourism Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Treatment Type:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

Breakup by Service Provider:

- Public

- Private

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145