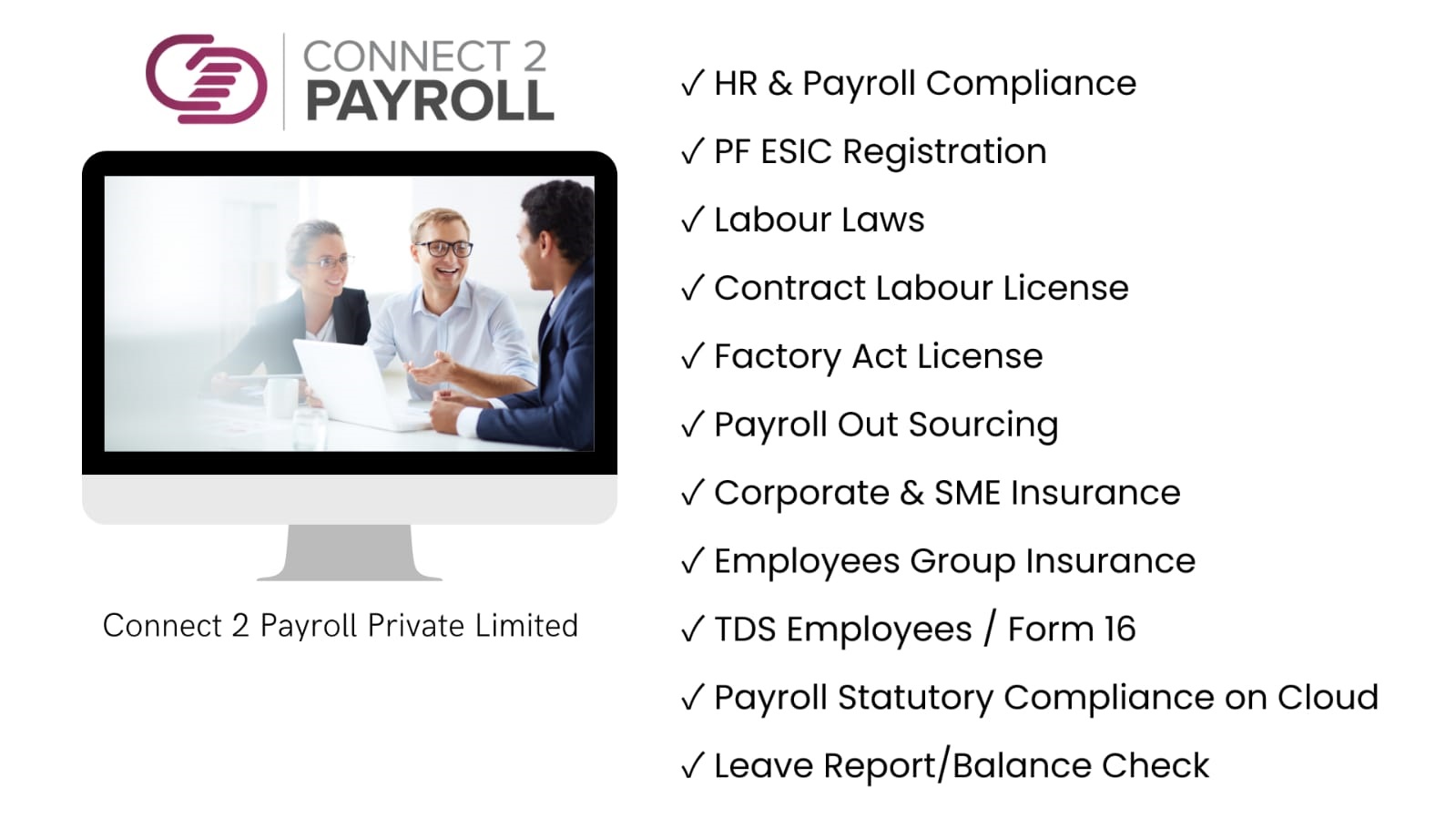

Connect 2 Payroll Solution Provider in Ahmedabad

Payroll Tax Consultant: Best Payroll Solution for Revised Complex TAX System

Should you choose to use a Payroll Tax Consultancy in India, it is vital to understand the significant influence the amended complicated tax system may have on your money.

Furthermore, any delay in the appropriate and timely tax payment might result legal issues. Knowing what payroll tax truly is and how a payroll tax advisor in your area may help you is therefore crucial. Connect 2 Payroll Solution Provider Company in Ahmedabad, India, USA, and Global.

Payroll tax is what?

A payroll tax is one imposed on the payroll kept by an employer. It covers all kinds of salary, benefits, wages, and other kind of compensation that firm gives its staff members.

Charging this tax ignores an employee’s history or situation.

Simply put, payroll taxes are those an employer must withhold or pay on their workers’ account.

Payroll Tax Categories

In India, payroll tax often falls into two categories:

Salary deductions

This is the tax an employer takes from their staff member’s pay. Usually, it pays for income tax (tax deducted at source). It can also be used, nevertheless, to offset the advance payment of disability and unemployment insurances.

Taxes paid instead of earnings

This is the tax an employee pays from their own money. Usually, it consists of the set fees imposed in relation to the employee’s pay. Contributions to social security, EPF, pension or other insurance schemes, for instance, fit this description.

A licensed tax consultant is someone who helps companies file their payroll taxes every financial year.

A qualified tax consultant is someone who guides companies in filing their payroll taxes each financial year. The company should, first and foremost, be quite credible in tax consulting. Knowing both accounting and finance is another prerequisite for a payroll tax advisor in India.

What Does a Tax Consultant Do?

The fundamental function of a payroll tax consultant in India is to effectively handle payroll taxes. This also covers the following:

– Tracking payroll taxes at both the employee and employer levels.

Reporting correct payroll taxes every month guarantees the employer’s ability to appropriately submit returns.

Ensuring the organisation follows the current tax code.

Reconciling payroll taxes to the general ledger and creating suitable journal entries.

Harmonizing tax operations with corporate goals.

Maintaining an open channel of communication between the employer and the staff member.

Simplifying complicated tax processes to promote greater knowledge.

Fixing tax compliance problems.

Ensuring that refunds and reimbursements are timely.

Apart from the above, a payroll tax consultant is also needed to handle any coordination problems and protect the interests of the company and its staff members.

Moving Ahead

A major link between the company and its staff members is a payroll tax advisor in India. Maintaining the company’s finances is ensured by timely tax filing. Payroll outsourcing is crucial, therefore you should place just as much attention on selecting a trustworthy payroll tax consulting company.

After all, the ideal answer to any complicated tax filing system or procedure would be a payroll tax specialist in your company. Connect 2 Payroll Service Provider Company in Ahmedabad, India, USA, and Global.