Market Overview 2025-2033

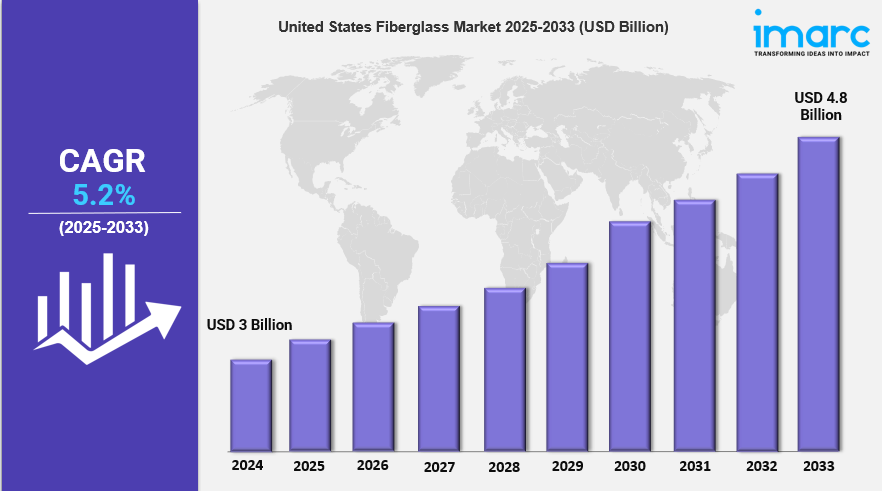

The United States fiberglass market size reached USD 3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The growing building and construction activities, the significant expansion of the marine sectors, and the widespread adoption of fiberglass composites in the automotive industry to improve fuel efficiency and reduce vehicle weight represent some of the key factors driving the market.

Key Market Highlights:

✔️ Robust growth driven by expanding construction and automotive industries

✔️ Rising demand for lightweight, durable, and corrosion-resistant materials

✔️ Increasing adoption of fiberglass in renewable energy and infrastructure projects

Request for a sample copy of this report: https://www.imarcgroup.com/united-states-fiberglass-market/requestsample

United States Fiberglass Market Trends and Drivers:

The growing infrastructure development across the United States is playing a major role in increasing demand for fiberglass materials. As governments and private players invest in commercial buildings, bridges, and residential projects, fiberglass is gaining traction due to its durability, low weight, and corrosion resistance. It is widely used in applications such as roofing, insulation, cladding, and reinforcement components.

Compared to traditional materials like wood or steel, fiberglass offers better strength-to-weight ratios and lower maintenance costs, making it a preferred choice in both new construction and renovation projects. In addition, the push for energy-efficient and sustainable buildings has accelerated the adoption of fiberglass insulation products. In 2025, the surge in public infrastructure spending, coupled with green building initiatives, is expected to significantly impact the United States fiberglass market size, reinforcing its role as a vital material in modern construction.

The need to improve fuel efficiency and reduce emissions is leading automotive manufacturers to use lightweight materials like fiberglass in vehicle production. Fiberglass composites are being adopted in the manufacturing of vehicle bodies, interior components, and structural parts due to their excellent mechanical properties and resistance to corrosion.

Electric vehicle (EV) manufacturers, in particular, are leveraging fiberglass to reduce vehicle weight and enhance battery performance. Additionally, fiberglass is being used in the marine and rail industries for components that require durability under stress and exposure to harsh conditions. In 2025, this growing trend toward lightweight and sustainable materials is anticipated to increase the United States fiberglass market share, as automakers and transport equipment manufacturers expand their use of composite materials to meet regulatory and performance goals.

The clean energy movement in the United States has led to a notable rise in the demand for fiberglass, particularly in the wind energy sector. Fiberglass is a key material in the production of wind turbine blades due to its high strength, flexibility, and resistance to environmental degradation. As states continue to invest in renewable energy infrastructure, the installation of new wind farms is accelerating, creating opportunities for fiberglass manufacturers.

Additionally, fiberglass is being used in solar panel components, utility enclosures, and piping systems associated with green energy projects. In 2025, as the renewable energy market expands in response to sustainability targets and federal support, the United States fiberglass market will benefit from increased consumption, cementing its position as a critical material in the transition to a low-carbon economy.

Speak to an analyst : https://www.imarcgroup.com/request?type=report&id=19116&flag=C

United States Fiberglass Industry Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Glass Product Type Insights:

- Glass Wool

- Direct and Assembled Roving

- Yarn

- Chopped Strand

- Others

Glass Fiber Type Insights:

- E-Glass

- A-Glass

- S-Glass

- AR-Glass

- C-Glass

- R-Glass

- Others

Resin Type Insights:

- Thermoset Resin

- Thermoplastic Resin

Application Insights:

- Composites

- Insulation

End Use Insights:

- Construction

- Automotive

- Wind Energy

- Aerospace and Defense

- Electronics

- Others

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Trending Reports By IMARC Group:

India Furniture Market: https://www.imarcgroup.com/india-furniture-market

India E-Commerce Market: https://www.imarcgroup.com/india-e-commerce-market

India Drones Market: https://www.imarcgroup.com/india-drones-market

India Facility Management Market: https://www.imarcgroup.com/india-facility-management-market

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145