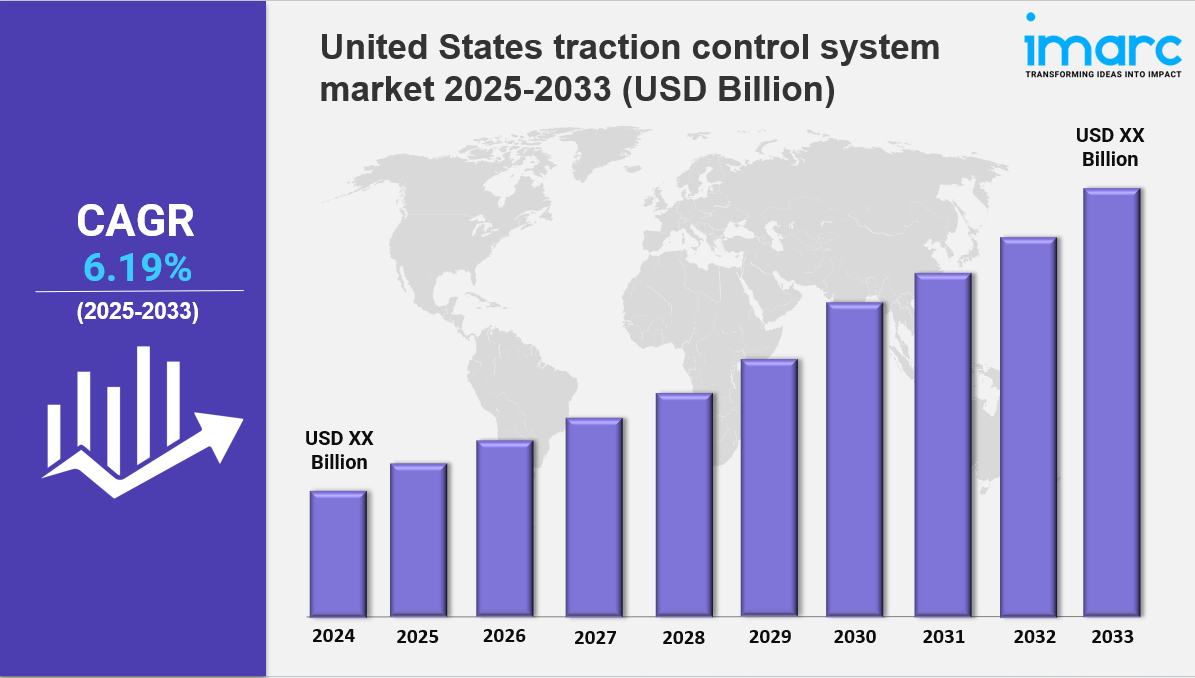

Market Overview 2025-2033

The United States traction control system market size is projected to exhibit a growth rate (CAGR) of 6.19% during 2025-2033. The market is witnessing steady growth, fueled by rising vehicle safety awareness, stringent government regulations, and increasing automotive production. Key trends include the integration of advanced driver assistance systems (ADAS), growing demand for electric vehicles, and a strong focus by manufacturers on enhancing vehicle stability, performance, and occupant safety through intelligent and responsive traction technologies.

Key Market Highlights:

✔️ Consistent growth driven by rising vehicle safety standards & production

✔️ Increasing integration of ADAS and smart traction technologies

✔️ Growing adoption in electric and high-performance vehicles

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-traction-control-system-market/requestsample

United States Traction Control System Market Trends and Drivers:

Vehicle safety remains a top priority for automakers and regulatory bodies alike, significantly shaping the trajectory of the United States traction control system market. As safety standards tighten and public awareness of in-vehicle safety features grows, manufacturers are increasingly integrating advanced traction control systems to minimize wheel slip and improve vehicle stability in varying road conditions. By mid-2025, this focus on accident prevention and compliance is expected to be a primary catalyst for growth across both passenger and commercial vehicle segments.

Regulatory mandates from agencies like the National Highway Traffic Safety Administration (NHTSA) are reinforcing the importance of traction control systems by making them essential for certification in new models. At the same time, safety-conscious consumers are influencing purchasing trends, prompting automakers to include traction systems in a wider range of vehicles—from high-end sedans to mainstream SUVs. These developments are steadily expanding the United States traction control system market size, driven by a mix of regulation and consumer demand.

Technological innovation is also playing a pivotal role, as traction control systems are now frequently integrated into advanced driver-assistance systems (ADAS). In 2025, this convergence is expected to significantly impact the United States traction control system market share, as OEMs develop unified platforms combining traction control with anti-lock braking, electronic stability control, and autonomous emergency braking. This integrated approach enhances real-time responsiveness and vehicle handling, particularly under adverse driving conditions.

The adoption of such systems is especially prevalent in electric and premium vehicles, where software-defined performance and seamless interconnectivity are key selling points. As automakers partner with tech firms to build modular, sensor-driven safety frameworks, the traction control system becomes a central piece of a smarter, more adaptive vehicle architecture. This shift not only improves functionality but also supports brand differentiation in a competitive landscape.

Meanwhile, the transition to electric mobility is having a transformative impact on the United States traction control system market outlook. Electric vehicles (EVs), known for their immediate torque delivery, require precise traction control to manage acceleration and maintain road grip. As EV sales rise and federal incentives accelerate consumer adoption, traction control is becoming a standard feature in electric drivetrains. By the middle of 2025, this trend is anticipated to contribute substantially to the United States traction control system market size, with automakers optimizing systems for real-time power distribution and terrain response.

High-performance EVs and SUVs are also pushing the boundaries of traction technology, demanding adaptive, AI-driven solutions capable of learning from road conditions and driver behavior. This intersection of electrification and intelligent safety is expected to be a key growth driver, reinforcing the importance of traction control systems in the future of mobility. As the market continues to evolve, these innovations will play a critical role in defining both the performance and safety benchmarks of modern vehicles, further strengthening the United States traction control system market.

United States Traction Control System Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- Mechanical Linkage

- Electrical Linkage

Breakup by Component:

- Hydraulic Modulators

- ECU

- Sensors

- Others

Breakup by Vehicle Type:

- ICE Vehicles

- Electric Vehicles

Breakup by Distribution Channel:

- OEM

- Aftermarket

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145